What's your property worth? Property assessment notices are here

Property owners received their 2018 assessment notices in the first week of January.

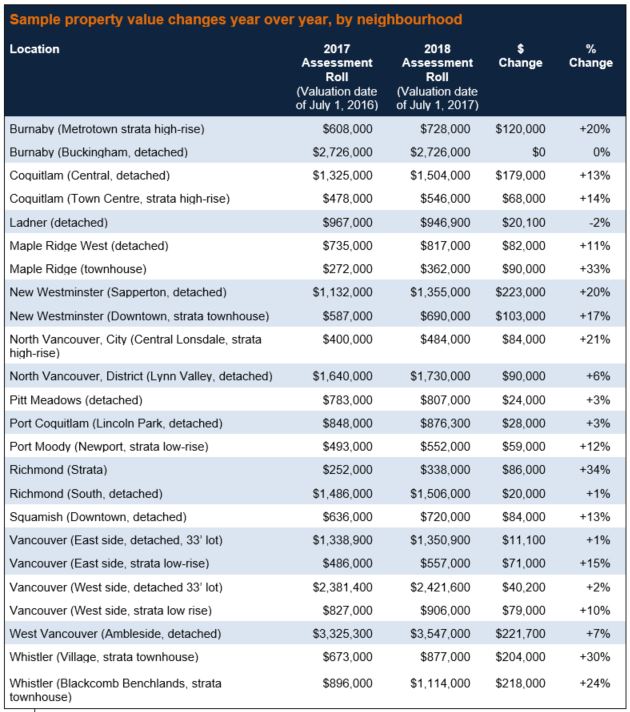

In Metro Vancouver, changes ranged from 5% decreases to 15% increases for detached homes. Residential strata units increased from 5% to 35%. Commercial properties increased from 5% to 50%. Property owners with significant increases received a warning assessment in early December 2017.

The 2018 Assessment Notice is BC Assessment’s (BCA’s) estimate of a property’s value as of July 1, 2017. For new construction or substantially renovated homes, the estimate is based on the physical condition as of October 31, 2017.

BCA is a publicly-owned provincial Crown corporation responsible for determining and reporting property value estimates. This year it reported 2,290,960 properties in its database, an increase of 1.3% from 2017. BCA has produced the assessment roll since 1974.

BCA’s assessment and a REALTOR’S® assessment: Why the difference?

BCA’s assessment and the market value determined by a Realtor may be different.

Both BCA assessors and Realtors calculate market value by analyzing sales of comparable homes within a local market, and look at factors that affect value such as size of home, view, location, number of bedrooms, construction quality, floor level, and garage or parking stalls.

Where every lot and every home on a street are typically the same, both BCA’s value and a Realtor’s value may be similar during stable market conditions.

Differences occur in neighbourhoods where lots have been rezoned or are different shapes and sizes, where architecture and views are unique, and where owners have made changes that BCA hasn’t yet considered.

As well, BCA assessments reflect values as of July of 2017 while Realtors’ evaluations are based on current market conditions.

When you view your assessment

Property owners can look up their assessments through e-valueBC on BCA's website.

Details include a photo, a property description (land and buildings), the total assessed value, the previous year’s value, the legal description, and property ID.

If details are incorrect, owners can complete and submit an e-valueBC Data Validation Form.

Owners can also compare neighbouring properties and sample sold properties to decide whether their property has been correctly assessed.

Deadline to appeal assessment is January 31, 2018

Owners who disagree with their assessment should:

- compare their assessment with neighbouring properties, and

- contact BCA at 1-866-valueBC (1-866-825-8322) to talk to staff who can make adjustments if there’s an obvious error, for example if BCA included a complete renovation when there was merely a spruce-up.

Property owners who decide to appeal their assessment should review information on the Property Assessment Appeal Board website on how to prepare for an appeal and then complete a Notice of Complaint (Appeal) Form. (Step 7)

Each year less than 1% of BC property owners appeal their assessments.

Note: you can’t appeal your taxes. You can only appeal your assessment.

For information about BC Assessment and to access e-valueBC visit: www.bcassessment.ca or phone 1-866-valueBC (1-866-825-8322).

Did you know?

The value of the 2018 BC assessment roll is $1.86 trillion, an increase of nearly 12% from 2017.

In BC, 88% of properties are classified with some residential component (class 1), equating to $1,445,509,108,324 ($1.4 trillion).

Changes in property assessment reflect movement in the local real estate market and can vary greatly from property to property.

Real estate sales determine a property’s value which is reported annually by BCA.

BCA’s assessment roll provides the foundation for local and provincial taxing authorities to set property taxes each year which funds community services including the school system.

Property tax

Property taxation is set by local and provincial taxing authorities after determining their budget needs and calculating property tax rates based on the assessment roll for their jurisdiction.

Municipalities determine tax rates for each property class in the spring, once the assessment roll is finalized. Changes in assessment value don’t automatically translate into the same changes in property taxes for any class of property or for any individual property.

Questions? Contact BC Assessment

Home Owner Grant increases

The Home Owner Grant is a provincial grant which reduces the amount of property tax an owner pays. To qualify you must be the registered owner and you must:

- occupy the home as your principal residence;

- be a Canadian citizen or permanent resident of Canada; and

- live in BC.

The Home Owner Grant threshold applies across the province. It is $1.65 million in 2018.

The amounts are:

- $570 for the basic grant.

- $770 if the home is located in a northern or rural area.

- Up to $845 for homeowners who are 65 years or older, or the homeowner is a person with a disability.

- Up to $1,045 for homeowners who are 65 years or older, or the homeowner is a person with a disability if the home is in a northern or rural area.

The Home Owner Grant phases out at a rate of $5 for every $1,000 above the threshold. Because homeowners can qualify for different grant amounts, they fully phase out at different amounts of assessed value.

In Metro Vancouver, Capital Region, and the Fraser Valley Regional District, the basic grant fully phases out at $1,764,000, and the higher grant at $1,819,000.

In northern and rural areas, the basic grant fully phases out at $1,804,000 and the higher grant at $1,859,000.

Partitioning may help reclaim some of the Home Owner Grant on a high value property

- the owner couldn’t, or could only claim a reduced grant, because of the high assessed value of the property; and

- the property consists of the owner’s principal residence and at least one separate residence, such as a laneway home.