Filter by

Home Buying

Friday, October 15, 2021

To increase your chances of qualifying as a self-employed borrower, you’ll need to be familiar with what lenders require and what questions they’ll ask.

Home Ownership

Thursday, June 10, 2021

How can older home owners cover their expenses without selling their home?

Legislation & Regulations

Tuesday, June 1, 2021

The new rules will dampen mortgage credit growth, but should have a modest effect on home sales and prices in the region going forward.

Home Buying

Friday, May 14, 2021

Before you begin home hunting, get prepared using these five simple steps to mitigate your risk so there are no unwanted surprises in one of the biggest financial decisions of your life.

Home Buying

Thursday, April 29, 2021

Here's what hopeful home buyers need to know to successfully navigate Metro Vancouver’s hectic housing market.

Home Buying

Friday, April 9, 2021

The Office of the Superintendent of Financial Institutions began consultation yesterday on a proposed increase to the minimum qualifying rate for uninsured mortgages.

Market Trends

Tuesday, March 9, 2021

In a busy real estate market, homes are bought and sold at a faster pace than usual. This can create a sense of urgency that causes home prices to rise.

Home Ownership

Friday, October 2, 2020

Market Trends

Tuesday, August 25, 2020

Home buyers with less than a 20 per cent down payment applying for a high-ratio mortgage with a regulated financial institution are typically offered a contract mortgage interest rate.

Home Buying

Thursday, August 20, 2020

Home buyers with less than a 20 per cent down payment applying for a high-ratio mortgage with a regulated financial institution are typically offered a contract mortgage interest rate.

Home Buying

Thursday, July 2, 2020

Angela talks about how the mortgage market is evolving.

Home Buying

Friday, June 19, 2020

Angela discusses how the COVID-19 pandemic is changing the mortgage market and gives you helpful advice.

Home Buying

Friday, June 19, 2020

Effective July 1, 2020, it will be more difficult to buy a home if you’re a first-time buyer.

Home Buying

Wednesday, June 3, 2020

Read our new Expert Series of articles, starting with how lower interest rates will affect your mortgage, and preparing to apply for a mortgage.

Home Buying

Tuesday, March 3, 2020

The benchmark rate used to determine the minimum qualifying rate for insured mortgages, known as the “stress test" is changing.

Legislation & Regulations

Wednesday, March 20, 2019

Federal Budget 2019 includes initiatives for first-time buyers, renters and measures to prevent tax non-compliance and money laundering.

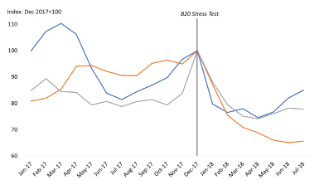

Market Trends

Thursday, August 16, 2018

It's clear housing demand has subsided. As sales trend down, prices are beginning to follow, but what's causing this?

Fact Sheets

Wednesday, February 7, 2018

Under the Canadian Bank Act, the federal government requires federally regulated financial institutions to insure high-ratio mortgages – less than a 20 per cent down payment – against default. Understand mortgage insurance by using this fact sheet.

Home Ownership

Thursday, February 1, 2018

When you're looking to buy a home, it's important to understand the steps for getting a mortgage.

Home Buying

Wednesday, January 24, 2018

An impending housing bubble said to be caused by foreign buyers bidding up home prices, and the rising debt levels of Canadians, have dominated the news in the past few years.